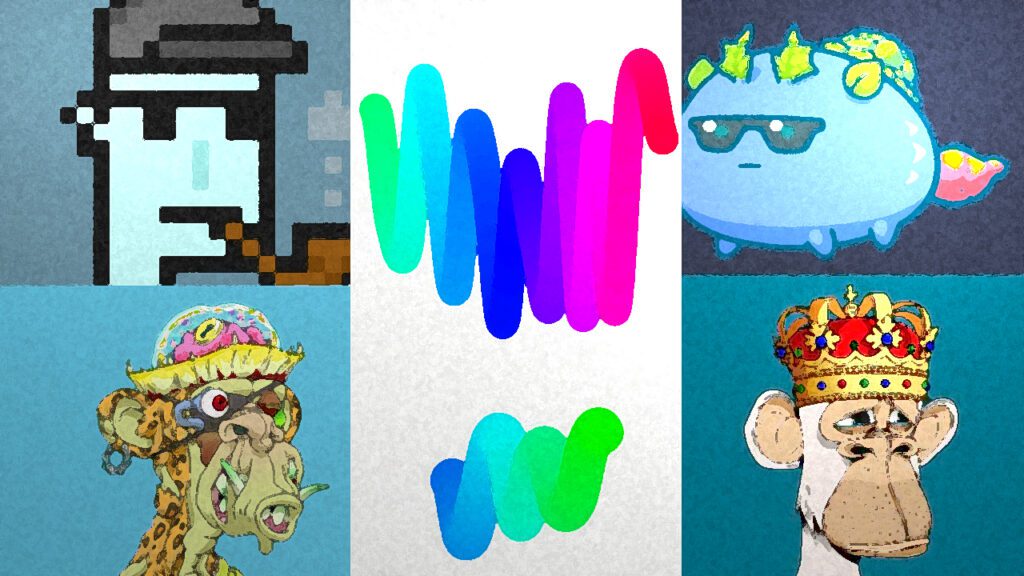

NFT Sales Drop 5.4% to $193M, Ethereum Dominates with $107M in Sales: Weekly Recap

Over the past week, statistics show non-fungible token (NFT) sales totaled $193.08 million, down 5.44% from the previous week. Ethereum dominated NFT sales with more than $107 million or 55% of all sales, while Solana-centric NFT sales recorded $26.3 million or 13% of sales in the same period. NFT Market Shows Signs of Slowdown With […]

NFT Sales Drop 5.4% to $193M, Ethereum Dominates with $107M in Sales: Weekly Recap Read More »