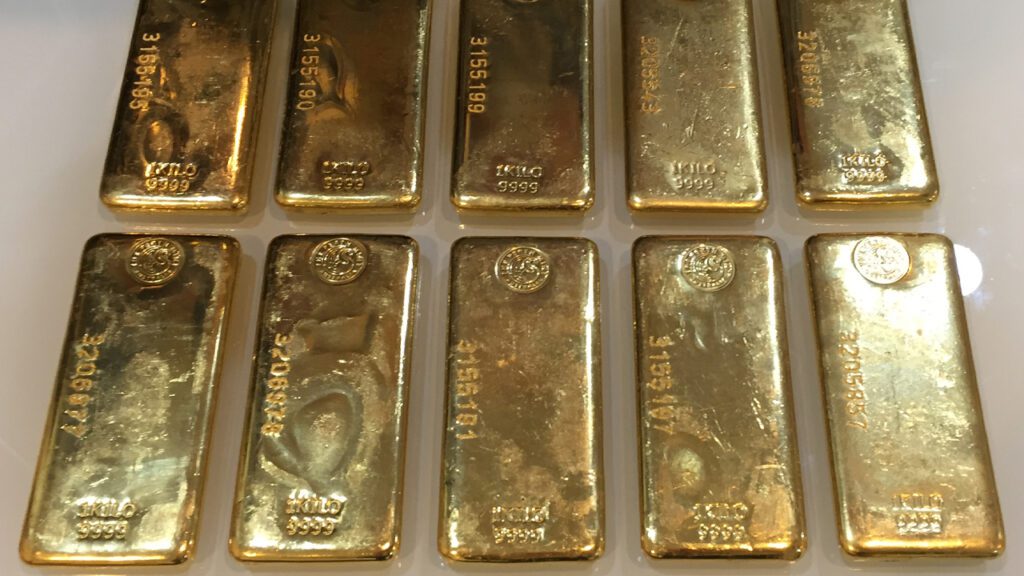

Analysts Suspect Banking Crisis Triggered ‘Resting Bull Market’ in Gold, Silver Could Print Much Higher Gains

At the start of the week, a troy ounce of .999 fine gold was trading at $1,813 per unit. Seven days later, gold rose 9.65% against the U.S. dollar to the current spot price of $1,988 per ounce. Gold’s rise comes at a time when confidence in the global banking system is at an all-time […]